2025 Marginal Rate Tables. You pay tax as a percentage of your income in layers called tax brackets. Welcome to the 2025 income tax calculator for australia which allows you to calculate income tax due, the effective tax rate and the marginal tax rate based on your.

T210156 Effective Marginal Tax Rates on Wages, Salaries, and Capital, Your marginal tax rate is the tax rate that you pay on your highest dollar of taxable income. A marginal tax rate is the amount of additional tax you incur for added levels of income.

T220117 Effective Marginal Tax Rates on Wages, Salaries, and Capital, Last updated 5 june 2025. The federal marginal tax rate for individuals in the united states.

T160205 Effective Marginal Tax Rates (EMTR) On Wages and Salaries, You pay tax as a percentage of your income in layers called tax brackets. On 25 january 2025, the government announced changes to individual income tax rates and thresholds from 1 july 2025.

T200069 Effective Marginal Tax Rates on Wages, Salaries, and Capital, The 32.5% tax rate decreases to 30%; However, you can use them in advance to plan out any personal finance moves to lower the tax bill you’ll pay in 2025.

T220117 Effective Marginal Tax Rates on Wages, Salaries, and Capital, The united states imposes a progressive tax system. You pay tax as a percentage of your income in layers called tax brackets.

T160221 Effective Marginal Individual Tax Rates (EMTR) On, A marginal tax rate is the amount of additional tax you incur for added levels of income. Tax rates for australian residents for income years from 2025 back to 1984.

T220118 Effective Marginal Tax Rates on Wages, Salaries, and Capital, The tax scale shown here is based. The federal marginal tax rate for individuals in the united states.

Marginal emission control costs and marginal health benefits in 2025 as, Your marginal tax rate is the tax rate that you pay on your highest dollar of taxable income. 2025 us tax tables with 2025 federal income tax rates, medicare rate, fica and supporting tax and withholdings calculator.

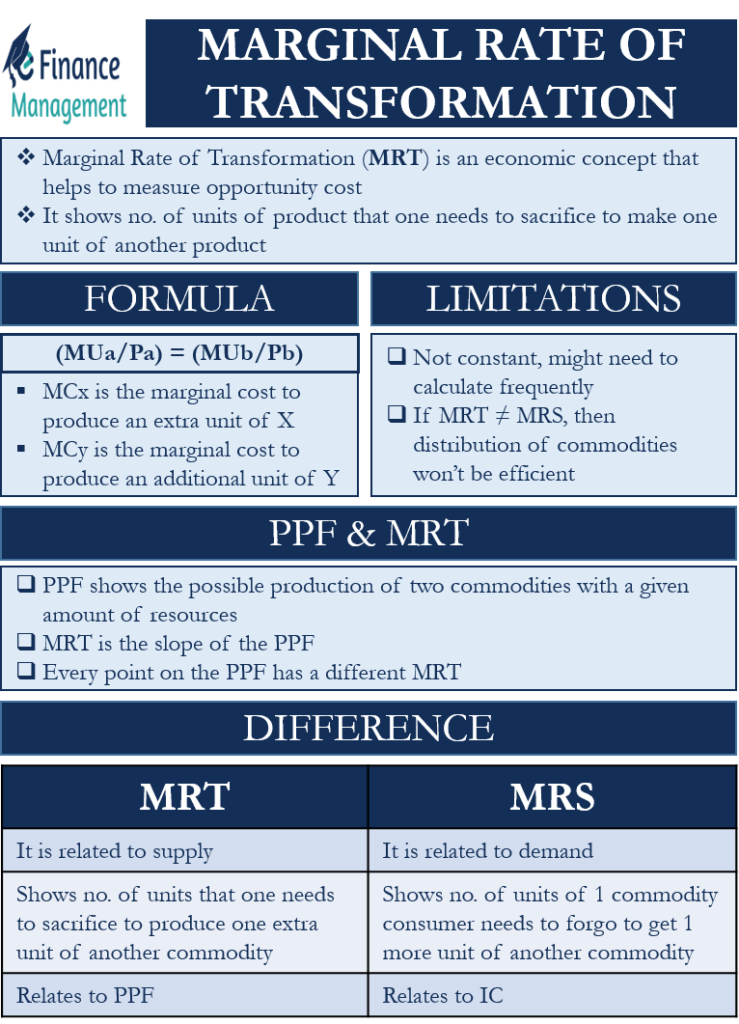

Marginal Rate of Transformation Meaning, Formula and Limitation, However, you can use them in advance to plan out any personal finance moves to lower the tax bill you’ll pay in 2025. Welcome to the 2025 income tax calculator for australia which allows you to calculate income tax due, the effective tax rate and the marginal tax rate based on your.

How Do Marginal Tax Rates Work — and What if We Increased Them?, The top marginal tax rate of 45 per cent rate will apply to taxable income above $190,000. However, you can use them in advance to plan out any personal finance moves to lower the tax bill you’ll pay in 2025.